what constant daily hire rate beginning in 2006 leads to an npv of $0?

Nowadays Value Formula(Table of Contents)

- Formula

- Examples

- Calculator

What is the Present Value Formula?

The term "nowadays value" refers to the application of time value of money that discounts the future cash flow to get in at its present-day value. The discounting rate used for the nowadays value is determined based on the electric current market return. The formula for nowadays value can be derived by discounting the future cash catamenia past using a pre-specified rate (discount rate) and a number of years.

Formula For PV is given below:

PV = CF / (1 + r) t

Where,

- PV = Present Value

- CF = Futurity Cash Catamenia

- r = Discount Charge per unit

- t = Number of Years

In case of multiple compounding per yr (denoted by n), the formula for PV tin be expanded as,

PV = CF / (1 + r/n) t*n

Examples of Nowadays Value Formula (With Excel Template)

Let'southward take an case to empathize the adding of the Nowadays Value in a meliorate style.

You lot can download this Present Value Formula Excel Template hither – Present Value Formula Excel Template

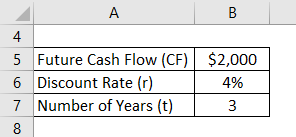

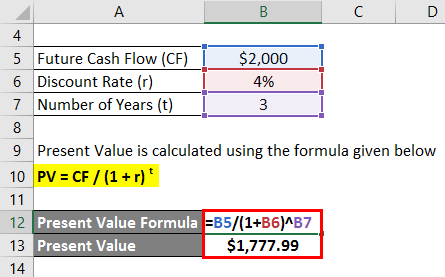

Nowadays Value Formula – Example #ane

Let u.s.a. take a simple example of $2,000 time to come greenbacks period to be received afterward 3 years. Co-ordinate to the current market trend, the applicable discount rate is 4%. Calculate the value of the future cash menstruation today.

Solution:

Present Value is calculated using the formula given below

PV = CF / (1 + r) t

- Nowadays Value = $ii,000 / (ane + 4%) iii

- Nowadays Value = $ane,777.99

Therefore, the $2,000 cash flow to be received after three years is worth $i,777.99 today.

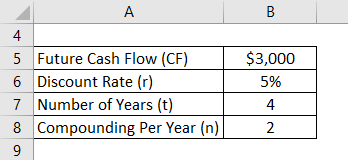

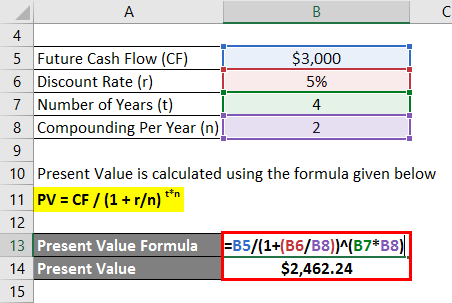

Present Value Formula – Example #2

Let us take the example of David who seeks to a certain amount of money today such that later 4 years he tin can withdraw $3,000. The applicative discount rate is five% to be compounded one-half yearly. Calculate the amount that David is required to deposit today.

Solution:

Present Value is calculated using the formula given below

PV = CF / (1 + r/n) t*due north

- Present Value = $3,000 / (i + v%/two) 4*two

- Present Value = $2,462.24

Therefore, David is required to deposit $2,462 today so that he tin can withdraw $3,000 after 4 years.

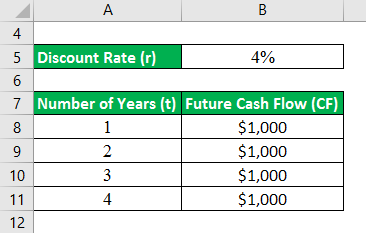

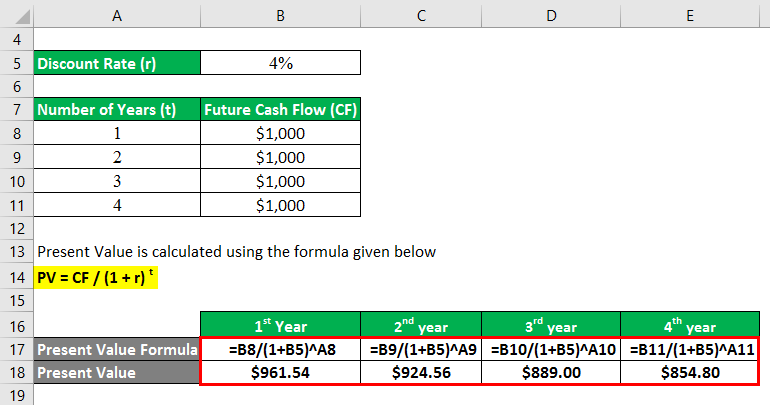

Present Value Formula – Case #3

Let us take some other example of John who won a lottery and as per its terms, he is eligible for yearly cash pay-out of $1,000 for the side by side 4 years. The disbelieve rate is four%. Summate the nowadays value of all the future greenbacks flows starting from the end of the current twelvemonth.

Solution:

Present Value is calculated using the formula given beneath

PV = CF / (1 + r) t

For 1st Year,

- Present Value = $1,000 / (1 + 4%)1

- Present Value = $961.54

For 2nd Year,

- Present Value = $1,000 / (1 + 4%)2

- Present Value = $924.56

For 3rd year,

- Present Value = $ane,000 / (1 + 4%)3

- Present Value = $889.00

For 4th year,

- Present Value = $ane,000 / (i + 4%)4

- Nowadays Value = $854.80

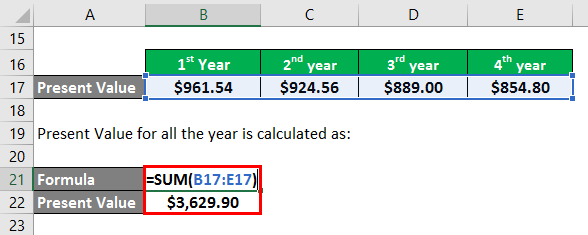

Present Value for all the yr is calculated as:

- Present Value= $961.54 + $924.56 + $889.00 + $854.fourscore

- Present Value = $iii,629.ninety

Therefore, the present day value of John's lottery winning is $3,629.90.

Explanation

The formula for present value can exist derived by using the following steps:

Footstep 1: Firstly, figure out the hereafter cash period which is denoted by CF.

Step 2: Next, decide the discounting rate based on the current market place return. It is the rate at which the future cash flows are to be discounted and it is denoted by r.

Step 3: Adjacent, figure out the number of years until the time to come greenbacks flow starts and information technology is denoted by t.

Step four: Finally, the formula for present value tin be derived past discounting the future cash (stride one) flow by using a discount rate (step 2) and a number of years (footstep 3) as shown below.

PV = CF / (1 + r) t

Step 5: Further, if the number of compounding per year (n) is known, and so the formula for present value can exist expressed as,

PV = CF / (one + r/due north) t*northward

Relevance and Uses of Present Value Formula

The concept of nowadays value is primarily based on the time value of money which states that a dollar today is worth more than a dollar in the time to come. However, there is a limitation of present value calculation equally information technology assumes that the same rate of return would be earned over the unabridged period of time – no charge per unit of return tin be guaranteed for any investment as various market place factors can impact the charge per unit of render negatively resulting in erosion of the nowadays value. As such, the assumption of an advisable discount rate is all the more than important for right valuation of the future cash flows.

Nowadays Value Formula Calculator

Yous can use the following Nowadays Value Calculator

Recommended Articles

This has been a guide to Present Value Formula. Here we discuss How to Calculate Present Value along with practical examples. We likewise provide a Nowadays Value Figurer with downloadable excel template. Y'all may also await at the following articles to learn more –

- Guide to Nowadays Value Factor Formula

- Examples of Variance Analysis Formula

- How to Calculate Sample Standard Divergence?

- Population Variance Formula with Excel Template

Source: https://www.educba.com/present-value-formula/

0 Response to "what constant daily hire rate beginning in 2006 leads to an npv of $0?"

Post a Comment